As from 2024, the RBG makes use of new tax bills. The bill has become clearer, with the most important matters now listed on the front page.

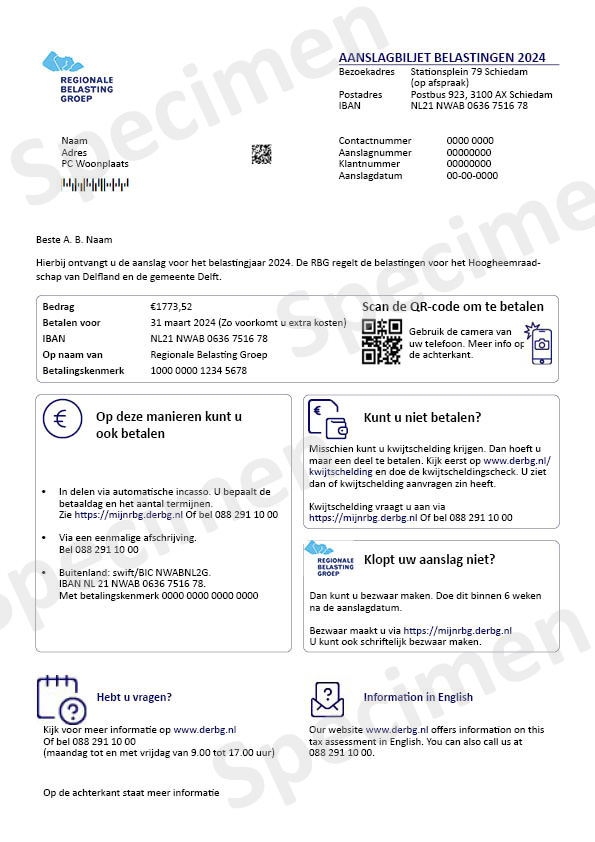

Example tax bill

What matters are listed on the front page?

- All payment details are listed in the payment box

- If you pay by direct debit, this is stated in the payment box

- When paying by direct debit, we specify when we will withdraw what amount from your account

- The other methods that may be used for payment

- What you can do if you cannot pay

- What you can do if your tax bill is incorrect

- Who you can call if you have questions

- Where you can find the information in English

What matters are listed on the back page?

- If we determine your WOZ value, you can find your WOZ assessment here. Do you have questions about your WOZ value? Then the information in yellow states what you can do

- Your taxes are listed in the tax overview. The rates are listed on our rates page

- How to scan the QR code on the front page

- Other matters you can arrange yourself via My RBG

- How to receive your tax bill digitally

- How to get help with payment problems

Do you have questions about your tax bill?

On the tax bill explanation page letter explanation/tax bill you can find many answers to questions about the tax bill.

You can also contact our Customer Contacts team at 088 291 10 00. Our team is available on working days from 9 am to 5 pm.