You will soon receive your 2022 tax assessment. The assessment shows the WOZ value of your property as of 1 January 2021. The WOZ value has increased. This is the case throughout the Netherlands. There are sometimes misunderstandings about the increase in the WOZ value. We explain two of them below.

Misunderstanding 1: If the WOZ value increases, the OZB also increases

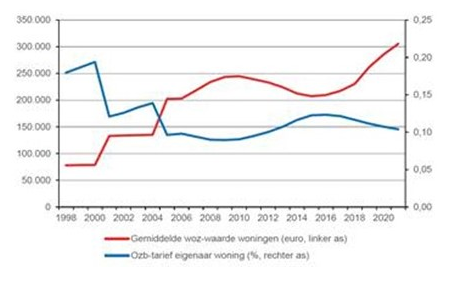

This statement is not correct. Municipalities set their tax rates annually. To do this, they first calculate how much tax revenue they need. Usually, municipalities lower their rates when the WOZ values increase. This way, they receive equal or slightly higher tax revenue for property taxes (OZB). The OZB rates for home owners have been reduced again this year.

Misunderstanding 2. Municipalities benefit from having the highest possible WOZ value

Again, this is not true. With a lower WOZ value, the municipality receives a higher payment from the municipal fund. Thus, municipalities are more likely to benefit from setting a lower WOZ value. Municipalities and tax offices want above all to determine the correct WOZ value. The Valuation Chamber checks annually whether they are properly implementing the Valuation of Immovable Property Act (Wet WOZ). And whether the quality of the appraisals is good. So not too high and not too low.

Why has the WOZ value in the Netherlands increased?

One of the reasons that the WOZ value has increased is the situation in the housing market at the moment. Due to the shortage of housing, homes are selling for increasingly higher amounts. This affects the market value and therefore the WOZ value of your home.

Would you like to know more about the WOZ value? Then please have a look at our WOZ page. For example, you can find information on

- which data we need to determine a correct WOZ value

- what role the Valuation Chamber plays

- where to go with questions

- where you can see your appraisal report.

Source: The increase in WOZ values in relation to municipal tax increase – VNG