When not to submit an objection

Still need to object? Then view the text below.

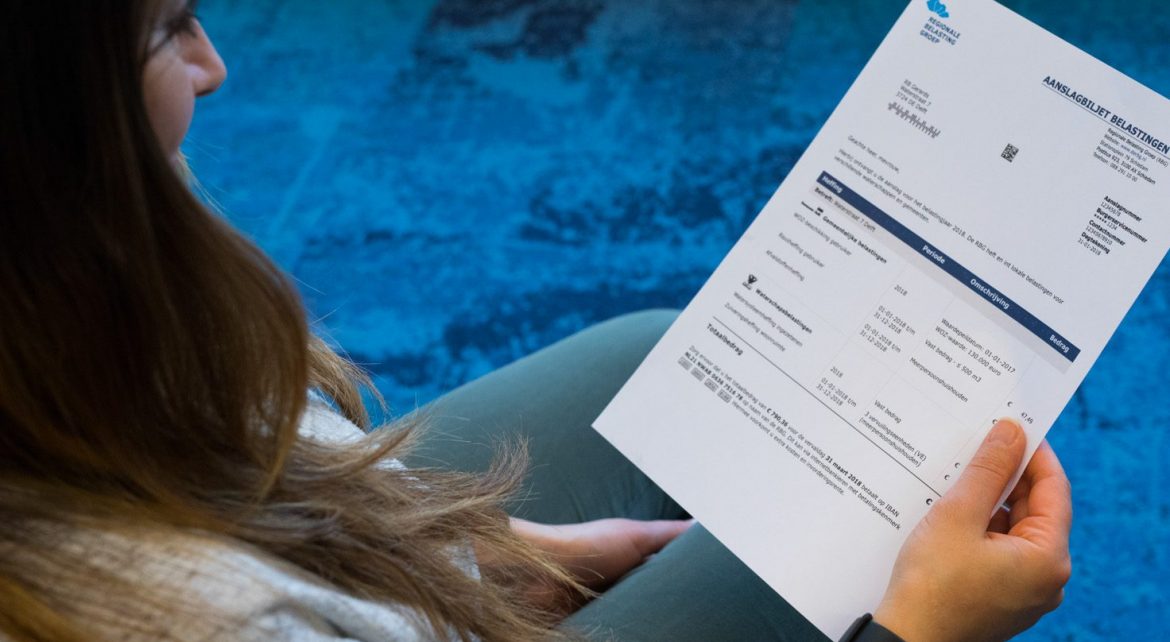

How does it work?

-

You submit an objection.

You can do this in digital form via My RBG, or in writing.

-

You will receive a confirmation of receipt within 2 weeks

Please pay the amount stated in this letter by the due date. Your objection does not apply to these taxes. You do not yet need to pay the other portion. This does not apply to objections to the WOZ value.

-

You will receive our decision within of the tax bill date

Submitting an objection is quick and easy

- Quick and easy via My RBG.

- Often an objection is not necessary.