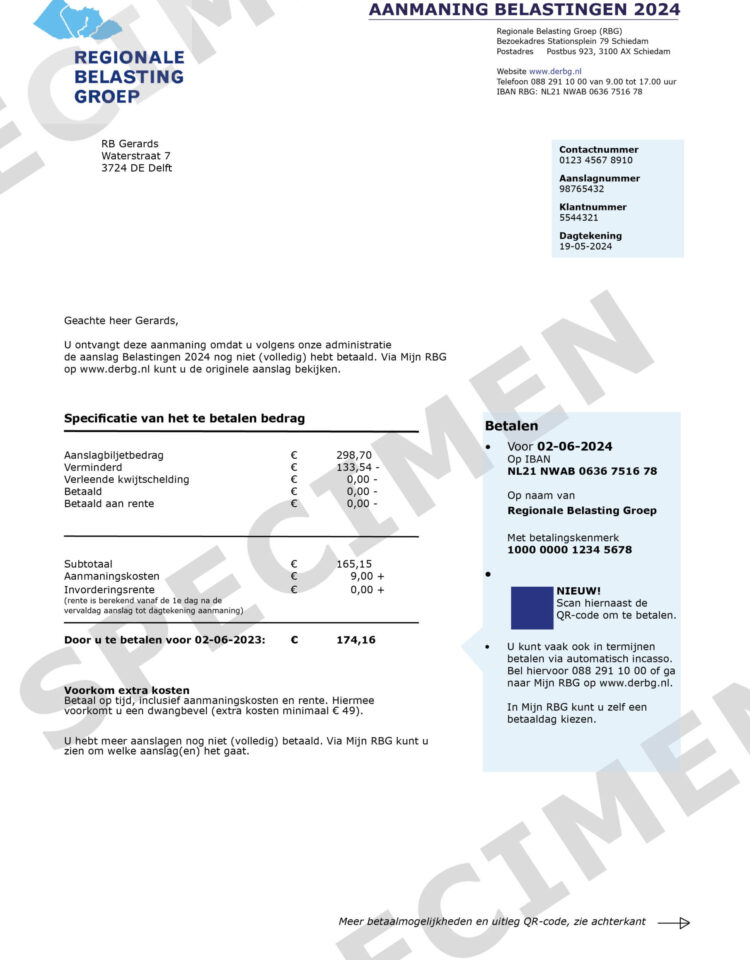

Unpaid tax assessment

The RBG sent you a tax bill. The tax bill was not yet paid. This is why you received a demand for payment letter.

Go through the demand for payment letter step by step?

The RBG sent you a tax bill. The tax bill was not yet paid. This is why you received a demand for payment letter.

Go through the demand for payment letter step by step?

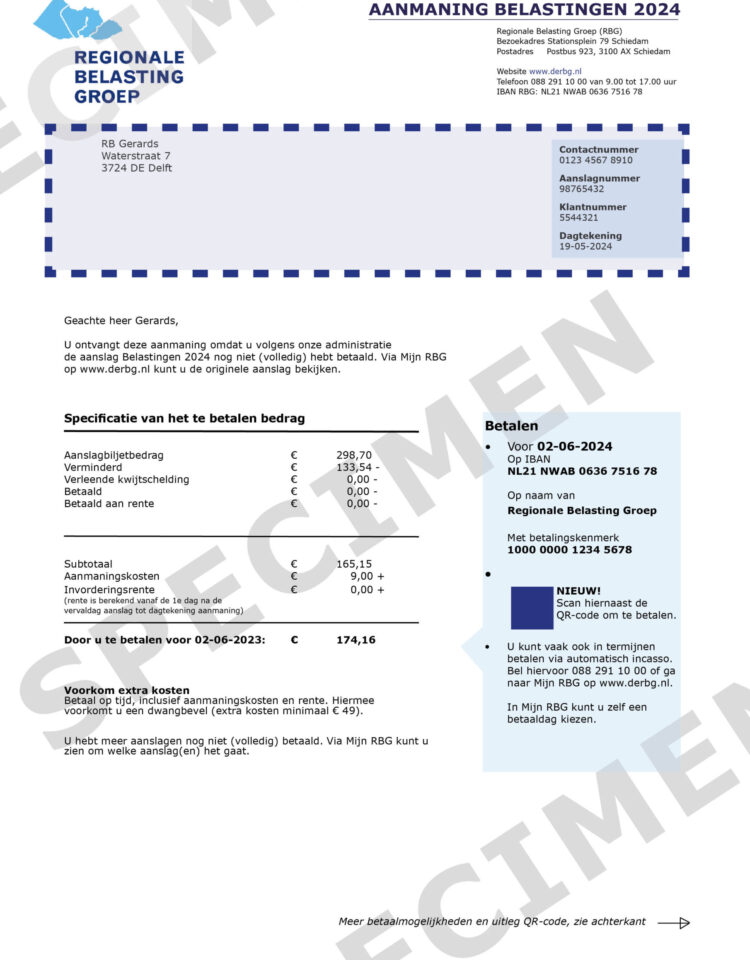

The demand for payment letter does not list the address that the tax bill refers to. This is generally the same as the correspondence address. You can view the tax bill via My RBG. This states the relevant address.

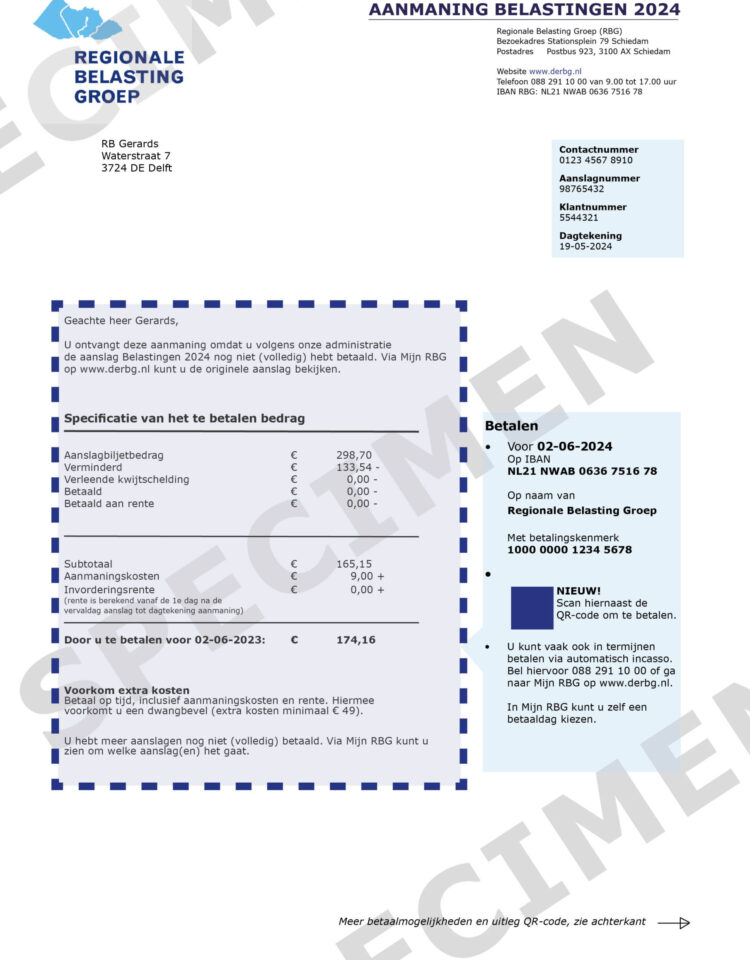

This shows the specification of the amount. It is important to pay the full amount due. Including the fees and the interest. This prevents receiving a writ of execution. The fees for a writ of execution amount to at least € 53.00.

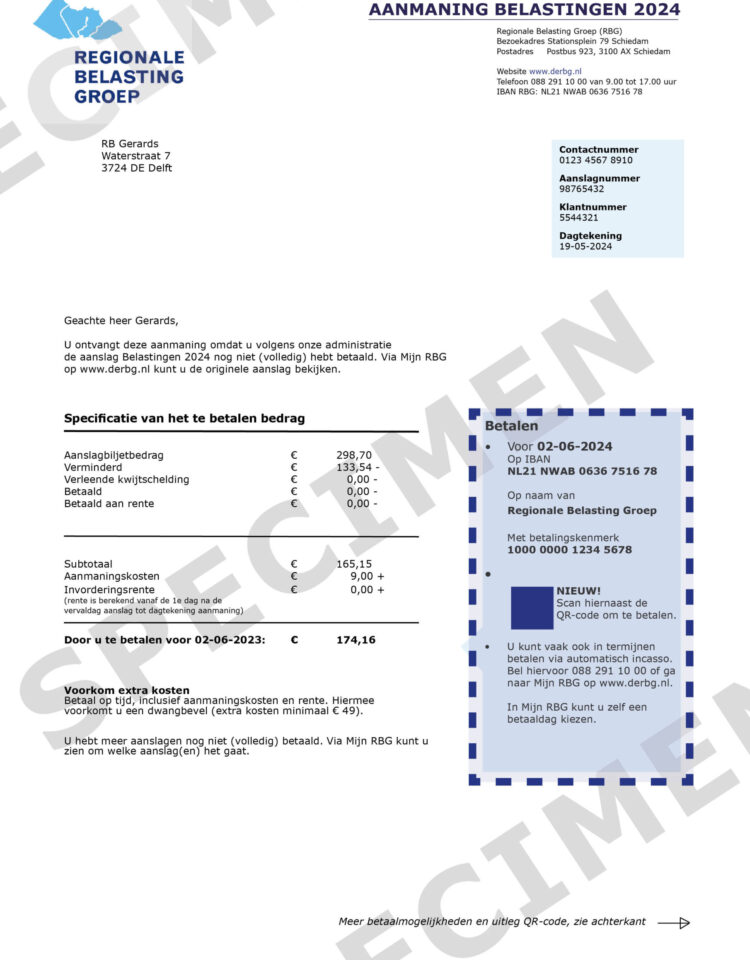

This shows all details you need for payment. Often you can pay in instalments. You can arrange it by telephone: on 088 291 10 00 or via My RBG. You can find more information on the payment page

The reverse shows more information. For example how to file a notice of objection against the fees of the writ of execution. And more about spread payment (payment in instalments) and a list of all payment options. And also an explanation of the QR code.